South Africa

• Reunert today released its unaudited interim financial report and cash dividend declaration for the six months ended 31 March 2016. Revenue from continuing operations increased by 2% from R3,9 billion to R4,0 billion, whilst operating profit increased by 12% from R503 million to R564 million. Normalised headline earnings per share (EPS) for the group, from continuing operations, increased by 12% from 239 cents to 268 cents. Basic EPS, on the same basis, increased by 11% from 246 cents to 272 cents, and headline EPS increased by 12% from 242 cents to 271 cents.

• Revenue for Altron’s financial year ended 29 Febraury 2016 declined by 4% to R26,6 billion and earnings before interest, tax, depreciation and amortisation (EBITDA) reduced by 73% to R376 million. Headline earnings per share (HEPS) declined to a loss of 145 cents from the profit of 94 cents posted in the prior year. Altech Radio Holdings performed well, growing revenue by 31% and EBITDA by 14%, primarily as a result of the Gauteng Broadband Network project which is being implemented on schedule and with an enhanced scope. Arrow Altech Distribution also performed well: while revenue was up 13%, margins remained stable and EBITDA was also up 13%. The business has successfully increased its market penetration, which has also reduced its dependency on intra-group business.

Overseas

Business

• Analog Devices announced $779 in revenue for the second quarter of fiscal year 2016, up 1% sequentially and down 5% year-over-year. Diluted EPS was $0,55, compared to $0,52 in the preceding quarter and $0,65 in the second quarter of last year.

• Sierra Wireless reported results for its first quarter ending March 31, 2016. Revenue for the first quarter of 2016 was $142,8 million, a decrease of 5,1% compared to the first quarter of 2015. Net earnings were $2,6 million, or $0,08 per diluted share, in the first quarter of 2016, compared to net earnings of $7,2 million, or $0,22 per diluted share, in the first quarter of 2015.

• Net sales for the fourth quarter of Microchip Technology’s fiscal 2016 were $557,6 million, up 2,7% from the prior year’s fourth fiscal quarter. Net income for the fourth quarter of fiscal 2016 was $67,4 million, or 31 cents per diluted share, down 32,2% from $99,4 million, or 45 cents per diluted share, in the prior year’s fourth fiscal quarter.

Companies

• ARM has acquired Apical, a global leader in imaging and embedded computer vision technology that will allow next generation devices to understand and act intelligently on information from their environment. Apical is one of the UK’s fastest-growing technology companies and its advanced imaging products are used in more than 1,5 billion smartphones and approximately 300 million other consumer/industrial devices including IP cameras, digital stills cameras and tablets. The acquisition, closed for a cash consideration of $350 million, supports ARM’s long term growth strategy by enabling new imaging products for next generation vehicles, security systems, robotics, mobile and any consumer, smart building, industrial or retail application.

Industry

• Component distributors in Europe have continued to enjoy a healthy business for more than 2 years now, culminating in an 8,4% growth in Q1/CY2016 compared to Q1/CY2015, according to DMASS (Distributors’ and Manufacturers’ Association of Semiconductor Specialists). The quarter ended with record sales of 1,93 billion Euros. Regionally, it was positive to note that Italy and Germany, the two biggest sales regions within DMASS, contributed over-proportionally to the quarterly growth. Germany ended Q1 with a plus of 11,7% at 606 million Euros, and Italy with a plus of 19,9% at 198 million Euros. Eastern Europe continued on its long-term growth path and grew by 15,3% to 265 million Euros (without Russia). The UK market suffered from its own currency problems and reported a 0,4% decline to 147 million Euros. France grew by 4,6% to 144 million Euros and the Nordic countries experienced a comparably steep decline of 7,7% to 163 million Euros.

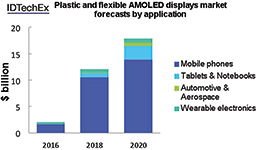

• IDTechEx Research has released new forecasts for the OLED display market, showing that it will reach nearly $16 billion this year and will grow to $57 billion in 2026. The two main manufacturers of OLED displays have both announced large investment to expand their production capacities. Samsung Display has plans to spend more than $3 billion between 2015 and 2017 to build a new production line, while rival LG Display is trying to lead the industry by committing over $9 billion for two new manufacturing plants.

• Worldwide semiconductor revenue will fall for a second consecutive year to $324 billion, down 2,3% from the previous year, according to the latest forecast from IDC. It also forecasts that semiconductor revenues will log a compound annual growth rate (CAGR) of 1,9% from 2015 to 2020, reaching $364 billion in 2020. According to the market update, the leading automotive semiconductor manufacturers continue to see dramatic change in market share, as Infineon Technologies displaces Renesas in the top spot, and STMicroelectronics moves ahead of the standalone Freescale.

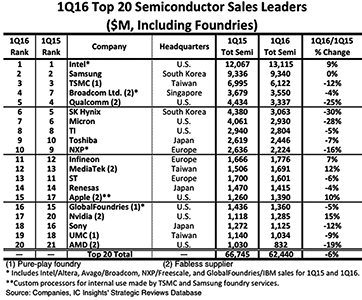

• IC Insights’ top-20 worldwide semiconductor sales rankings for the first quarter of 2016, as shown in the accompanying table, saw the seven top players recording double-digit declines. In all, top-20 sales dipped by 6% to $62,4 billion, one percentage point more than the total worldwide semiconductor industry decline of 7%. The rankings include eight suppliers headquartered in the US, three in Japan, three in Taiwan, three in Europe, two in South Korea and one in Singapore, a relatively broad representation of geographic regions.

Technology

• imec and Holst Centre demonstrated a low-power wide-area (LPWA) multi-standard radio chip which can operate with a lower level of power consumption than any other radio chip technology released to date for long-range connectivity in sensor networks. The sub-GHz technology can serve a multitude of protocols including IEEE 802.15.4g/k, W-MBUS, KNX-RF, as well as the popular LoRa and SIGFOX networks, and future cellular IoT for applications such as smart metering, smart home, smart city and critical infrastructure monitoring.

• STMicroelectronics and Arduino announced an agreement that brings the STM32 family of microcontrollers (MCU), along with ST’s full portfolio of sensing, power, and connectivity technology, closer to the Arduino maker community. The first product of the STAR (ST and Arduino) programme, the STM32F469-based STAR Otto baseboard, was demonstrated at the Bay Area Maker Faire in San Francisco. The board includes ST’s Chrom-ART graphics accelerator and MIPI DSI display interface along with an open-source software graphics library, in addition to a pre-integrated wireless link and audio capabilities, enabled by an ST MEMS microphone together with the necessary open-source drivers.

• Qualcomm is working with Google on an initiative to bring the power of Android OS embedded directly into the car. The initiative aims to help car makers create powerful infotainment systems using Android as a common platform, making it easier to add connected services and applications while delivering a safer and more intuitive driving experience. Concept car functions were demonstrated at the Google I/O event, running on the Qualcomm Snapdragon 820 automotive processor for connected cars and infotainment.

• Researchers at the Human Media Lab at Queen’s University have developed the world’s first holographic, flexible smartphone. The device, dubbed HoloFlex, is capable of rendering 3D images with motion parallax and stereoscopy to multiple simultaneous users without head tracking or glasses. HoloFlex features a 1920x1080 full high-definition flexible OLED touchscreen display. Images are rendered into 12-pixel wide circular blocks rendering the full view of the 3D object from a particular viewpoint. These pixel blocks project through a 3D printed flexible microlens array consisting of over 16 000 fisheye lenses. The resulting 160 x 104 resolution image allows users to inspect a 3D object from any angle simply by rotating the phone.

• Iowa State University researchers have made a breakthrough in making micro-scale, liquid-metal particles that can be used for heat-free soldering plus the fabricating, repairing and processing of metals – all at room temperature. Based on the principle of undercooling, whereby liquid metal is prevented from returning to a solid even below its melting point, the engineers experimented with a new technique that uses a high-speed rotary tool to sheer liquid metal into droplets within an acidic liquid. The particles are exposed to oxygen and then an oxidation layer is allowed to cover the particles, essentially creating a capsule containing the liquid metal. That layer is then polished until it is thin and smooth.

© Technews Publishing (Pty) Ltd | All Rights Reserved