South Africa

Altech, through its subsidiary Kenya Data Networks (KDN), announced the acquisition of an 8,5% stake in The East Africa Marine System (TEAMS) cable for an amount of US$11 million. The investment will give KDN a 10% voting right in TEAMS. Altech will fund its portion of the purchase price from cash reserves. KDN, a Kenyan company 60,8% held by Altech, is a ‘carrier-of-carriers’ telecommunications operator and Internet service provider, with fibre and radio infrastructure throughout East Africa.

Overseas

Business

Revenue for Analog Devices’ third quarter of fiscal 2009 was $492 million, an increase of 4% from the immediately prior quarter and a decrease of 25% from the same period one year ago. Diluted earnings per share (EPS) from continuing operations was $0,22, compared to $0,18 in the immediately prior quarter, and $0,44 in the year-ago period.

Cree announced record revenue of $148,1 million for its fourth quarter of fiscal 2009. This represents a 9% increase compared to revenue of $135,9 million reported for the fourth fiscal quarter last year and a 13% increase compared to the fiscal third quarter of 2009. GAAP net income for the fourth quarter was $9,7 million, or $0,11 per diluted share, compared to GAAP net income of $8,4 million, or $0,09 per diluted share, for the fourth quarter of fiscal 2008. For fiscal year 2009, Cree reported revenue of $567,3 million, which represents a 15% increase compared to revenue of $493,3 million for fiscal 2008. GAAP net income was $30,3 million, or $0,34 per diluted share, compared to $33,4 million, or $0,38 per diluted share for fiscal 2008.

Mentor Graphics announced results for the fiscal second quarter of 2010, ending 31 July 2009. For the quarter, the company reported revenues of $182,6 million, non-GAAP earnings per share of $0,02, and a GAAP loss per share of $0,22. For its third fiscal quarter, the company expects similar results with revenue of about $183 million, non-GAAP earnings per share of around $0,01 and a GAAP loss per share of about $0,19.

Companies

Fluke Networks signed an agreement to acquire AirMagnet, a leader in performance, security and compliance solutions for wireless LANs. The acquisition is expected to create a global leader in the fast growing area of Wi-Fi testing and further strengthen Fluke Networks’ worldwide leadership in test and analysis for networks, regardless of media type. Terms of the agreement have not been disclosed.

Abilis Systems, an RF semiconductor company, announced the acquisition of Freescale Semiconductor’s CMOS Modulators and Silicon Tuner product lines. The acquisition of these assets will allow Abilis to expand its portfolio of silicon-based digital TV (DTV) and tuner solutions and better address the needs of the growing digital TV market, and in particular of Digital Terrestrial Television (DTT) and cable platforms.

Bosch has agreed to acquire Akustica, an innovator in the application of CMOS MEMS technology in the consumer electronics market. Terms of the agreement were not disclosed. Akustica’s technology allows the integration of transducer elements and associated integrated circuits on a single silicon chip.

Industry

Austriamicrosystems announced the shipment of its one billionth high performance analog IC for the successful SiSonic series of MEMS microphones. Built on Knowles Acoustics’ CMOS/MEMS technology platform, which was originally launched in 2002, the SiSonic silicon-based microphone series is entering its fifth generation of development, with the overall product family shipping in excess of 1 billion units to date. The proven, and evolving, design series supports high-performance, high-density innovation in applications such as cell phones, notebooks, digital still cameras, portable music players and other portable electronic devices.

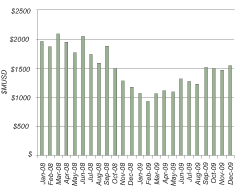

Databeans predicts that the semiconductor market serving the automotive industry is on the verge of recovery in the third quarter of this year in a U-shaped model with several months of near flat revenue, before a gradual increase in 2010. This is fuelled primarily by the Asia Pacific region with significant momentum during June and July. After hitting bottom in February 2009, where automotive semiconductor revenue came in at $931 million, there have since been several consecutive months of flat or slightly positive growth. June marked a turning point where momentum begun to gather, while in August, Databeans predicts some nominal growth followed by an even stronger September, after which strong recovery is expected moving forward into the first quarter of 2010. Overall by the end of 2009, Databeans expects the automotive semiconductor total available market to be just over $15 billion, thanks to emerging markets in Asia and recovery in established regions such as the US and Western Europe.

European sales for semiconductors grew on a three month rolling average basis by 5,3% in July compared with the previous month, according to a World Semiconductor Trade Statistics (WSTS) report. This is the third month of consecutive growth in Europe. This positive performance is in line with the developments observed in the other regions in July, with in particular Japan growing by 7,9 % and leading, for this month, the market rebound. Overall, European semiconductor sales in July 2009 amounted to $2,317 billion. This corresponds to a decline of 31,7% compared to the same month last year. On a year-to-date basis, semiconductor sales declined by 33,1% in 2009 versus the same period in the year 2008.

Worldwide semiconductor revenue is on track to total $212 billion in 2009, a 17,1% decline from 2008 revenue of $255 billion, according to the latest outlook by Gartner. This forecast is better than the second quarter projections when Gartner projected semiconductor revenue to decline 22,4% this year. While the outlook for 2009 has improved, Gartner analysts point out that all major segments of the semiconductor market are expected to experience double-digit declines in revenue this year. The largest segment of the semiconductor market, application-specific standard product (ASSP), will reach $57,2 billion in 2009, but this is a 16,5% decline from 2008 revenue. The memory market, the No. 2 segment, is forecast to total $41 billion, a 13,5% decline from last year. The microcomponents segment (microprocessors, microcontroller units, digital signal processors) is on pace to reach $39,4 billion in 2009, a 19,2% decline from 2008.

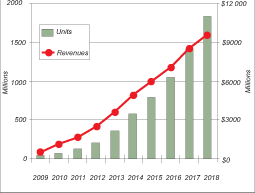

In a recent report, DisplaySearch forecast that the total e-paper display market will grow to 1,8 billion units and $9,6 billion in revenues in 2018, from 22 million units and $431 million in revenues in 2009, for a CAGR (compound annual growth rate) of 41% for revenues and 64% for units. The market for e-paper displays - which are found in e-books, e-textbooks, e-newspapers, e-magazines, mobile phones, electronic shelf labels, point–of-purchase and public signage displays, displays in smart and credit cards, clothes and other wearable items, and other applications—has taken off this past year, becoming one of the few shining stars in the economic downturn.

Technology

Atmel and Cryptography Research (CR) announced an agreement regarding the use of CR's patents to enhance the security of Atmel's tamper-resistant chips against differential power analysis (DPA) and related attacks. Under the agreement, Atmel receives the freedom to use CR's patents as part of its strategy to develop and enhance its security chips used in smartcards and other applications. The licence also covers software executing on Atmel chips, allowing Atmel's customers to develop their own security countermeasures without a separate licence from Cryptography Research. DPA is a form of attack that involves monitoring the fluctuating electrical power consumption of a target device and then using advanced statistical methods to derive cryptographic keys and other secrets.

© Technews Publishing (Pty) Ltd | All Rights Reserved