A mobile phone is more than a few chips and a battery. Most of a phone's insides are occupied by filters, duplexers and resonators – passive components that sort radio frequencies so that you get your calls and not someone else's.

These passive components present a major obstacle to the further shrinking of cellphones, and are being replaced with tiny machines called micro-electro-mechanical systems (MEMS).

MEMS devices that are most commonly incorporated into mobile phones include silicon microphones, 3D accelerometers, and gyroscopes for camera stabilisation and GPS. MEMS microphones have achieved success because of rapid adoption in the mobile handset market. Their relatively small sizes, ease of use, and competitive price have helped in garnering market share.

Functionality ideal for mobile phones

Silicon microphones have gradually started displacing electret condenser microphones (ECMs), which have been in use since the 1960s. Most MEMS microphones are modern representations of the standard condenser microphone. However, they offer certain advantages over the latter, making them more suitable for mobile phones.

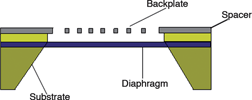

The diaphragm and the backplate that together form the capacitor in a MEMS microphone are up to 10 times smaller than the most compact ECM. In warm surroundings, the temperature inside the cellphone chamber can reach as high as 80°C. The ECM is not functionally equipped to handle such high temperatures but the MEMS equivalent is. MEMS microphones also offer the potential of noise cancellation through the use of microphone arrays.

Knowles Acoustics was the first to introduce the silicon MEMS microphone in 2003. By 2006, the company had gained more than 90% of the market share and shipped its 300 millionth MEMS microphone. It leads other participants such as Akustica, MemsTech, SonionMEMS and Infineon Technologies in volume.

Knowles Acoustics and Akustica announced in June 2007 that the companies will enter into a cross-licensing arrangement that would reinforce the strength of each company's respective patent portfolios; these two are the leading companies for silicon MEMS microphone design, manufacture and sales.

Technology trends

In June 2007, Akustica brought out a 1 mm² microphone that uses a MEMS diaphragm and on-chip CMOS analog circuitry. The small size of this analog MEMS microphone makes it suitable for cellphones.

MEMS microphone solutions from competitors such as Knowles Acoustics, SonionMEMS, and Infineon Technologies are two-chip solutions. Knowles Acoustics, for instance, mounts its MEMS diaphragm chip, which measures about 2,5 mm², alongside an ASIC. Akustica follows a system-on-a-chip approach while Knowles Acoustics works with a system-in-a-package approach.

Knowles Acoustics, SonionMEMS, and Infineon Technologies promote two-chip MEMS solutions as a more cost-efficient option. However, Akustica claims that its single-chip solution is much more immune to electromagnetic interference and hence is more suited for mobile phone applications.

The mobile phone market presents a significant opportunity for MEMS technology due to the large market size. MEMS microphone manufacturers have been targeting this opportunity in recent times. One of the short-term challenges will be that of high component manufacturing costs because of lower volumes when compared to ECMs. Frost & Sullivan believes that the ability of the manufacturers to achieve optimum cost structures, in spite of the high costs involved, will determine the extent of penetration into the mobile phone market.

Another key challenge is for the industry to cope with the entire gamut of technologies being used to manufacture MEMS microphones. Until recently, the industry only offered two-chip solutions. Today, however, there exist monolithic versions of the same, which have their own advantages.

This scenario poses a challenge to the market players regarding the effective positioning of products, in order to gain an edge over the competition.

Conclusion

MEMS components are climbing the popularity charts in the mobile phone market because they offer sizes and functions that have not been available before. In response, many MEMS manufacturing companies are changing their business strategies to cater to this low-cost, high-volume demand.

At present, microphones are the MEMS components that are most benefited by the cellphone market. Going forward, gyroscopes, RF switches, and oscillators are also expected to attract huge demand, especially in the high-end mobile phone market.

For more information contact Patrick Cairns, Frost & Sullivan, +27 (0)21 680 3274, [email protected]

© Technews Publishing (Pty) Ltd | All Rights Reserved