In response to the recently published article in Dataweek: 'Is there a future for local manufacture of industrial electronics?' we received a letter from Cadware’s Warren Gary Bilgeri who has completed his MBA research report on a similar topic, a synopsis of which follows.

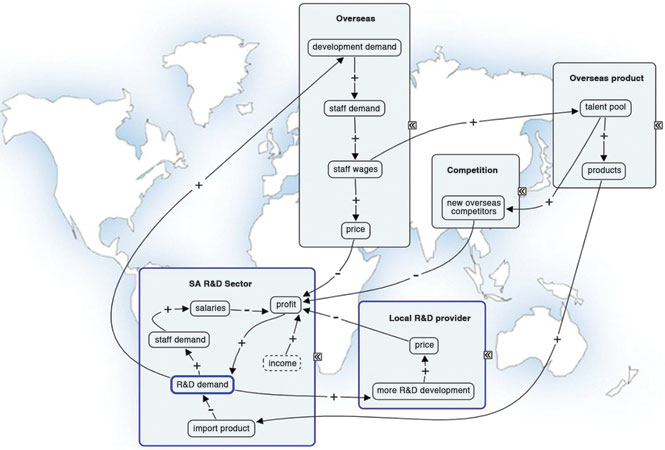

Globally, the practice of multisourcing is continuing to grow. Many companies are optimising the way research and development (R&D) is staffed internally, outsourced, or carried out offshore. This research was undertaken to determine the factors that drive and influence multisourcing in South African technology companies.

Multisourcing is defined as “the disciplined provisioning and blending of business and IT services from the optimal set of internal and external providers in the pursuit of business goals” (Cohen & Young, 2006, p. 3). Elements of multisourcing include internal staffing, outsourcing, offshoring and subcontracting.

An in-depth, qualitative interview method was used to gather data on the factors that influence multisourcing. Senior executives from various information technology and electronics companies were interviewed on their company’s multisourcing practices.

Many companies around the world are using various forms of multisourcing to remain competitive (Levina & Su, 2008). In order to be competitive, an optimal multisourcing mix is needed to ensure the fulfilment of business goals such as profits (Cohen & Young, 2006).

The review of available literature indicates that the outsourcing of R&D has great benefits if it is carried out correctly in appropriate circumstances. However, the outsourcing of R&D can negatively affect a company if the outsourcing process is not carried out correctly.

Research methodology

Qualitative research “is an effort to understand situations in their uniqueness as part of a particular context and the interactions there” (Patton, 1985, p. 1). Denzin and Lincoln (2005) expand on this definition by describing qualitative research as “a situated activity that locates the observer in the world” (Denzin & Lincoln, 2005, p. 3). A research interviewing technique is used to explore the multisourcing options that firms strategically use.

Electronics company selection was assisted by using Technews’ Electronic Buyers’ Guide (EBG, 2012), which parametrically lists electronics companies. This guide made it easy to find companies that have an R&D component, as these companies were listed in the development section of the guide.

An important limitation is that the possible differences in the profiles of the respondent categories may lead to a mixing of results, which may not be valid. A further limitation is a small sample size, which means that the sampled companies may not be representative of the actual IT and electronics industry in SA.

A total of 13 in-depth interviews were conducted across the IT and electronics technology sectors. Three of the companies, where companies were interviewed, consisted of a hybrid mix of IT and electronics disciplines.

Mixed resources

Staff are the most used resource for carrying out R&D. Companies indicated either that all or the majority of their R&D was done by staff. Reasons given for this are that the core competencies give the company its competitive edge and these skills must be retained within the company. These companies hope to retain their talented R&D staff for long periods of time, so that the skills that R&D staff acquire are also retained within the company.

The larger multinational companies indicated that they choreograph their staff on multinational projects and for training purposes. These companies can send staff to receive training in the company’s core competence at one of the multinational offices.

According to some companies, there is a shortage of skilled people in the R&D sector in South Africa. This makes it difficult for employers to find the right skilled staff. This demand means that talented R&D staff are expensive to employ when compared to the world’s average equivalent skilled staff rate.

Local outsourcing consists of the use of contractors or development houses. Most of the companies interviewed stated that local outsourcing is used to a certain extent. Local development houses or contractors excel in certain skill sets, so they have their own core competencies. In times of high R&D workload of a temporary nature, some companies may also choose to outsource work instead of hiring additional staff that may not be needed in the long-term future.

Some companies said that R&D that is outsourced may need enhancements and improvements at a later stage. They also felt that contractors and development houses could become potential competitors, as companies providing these outsourcing services gain know-how of their customers’ operations.

Most companies indicated that they do not offshore R&D work. However, some companies indicated that the industrialisation of the product and manufacturing occur overseas.

Companies are well aware that skilled labour is cheaper in Asian countries. These companies feel, however, that this approach is very risky for protecting intellectual property, as certain Asian countries are notorious for not respecting intellectual property rights. The overheads of managing offshore developments offset the benefits. Factors contributing to overheads are language barriers, cultural barriers and the distances involved.

Some companies indicated that they would purchase products from overseas if this made business sense. However, these products would usually not be what the companies believe to be the core competency of the business. Purchasing products in low volumes may also be used as an entry strategy to test new markets or to review existing competitive products to make sure that the future product is designed to exceed the competitive product’s specifications.

The top few percent of South African R&D staff are seen by some companies to match overseas staff in terms of talent. South Africa has some strongly internationally competitive industries such as mining, security and telemetry. Talented individuals providing R&D solutions in these areas are seen as better than overseas talent, as the talent from overseas does not have sufficient experience in these specific areas.

Many of the electronics-related companies feel that the electronics industry will not grow significantly and may even shrink. South Africa is not seen to become a large international player in this field. However, South Africa has some competitive industries such as mining, power and monitoring, security and telemetry. These industries create niche opportunities for electronics companies in SA.

Advice

R&D companies should identify what part of their R&D projects can be outsourced to contractors or other development houses. This part of the project must be clearly defined and ring-fenced so that the company undertaking the development is aware of what needs to be done. If it is expected that this undertaking may need future support, this should be discussed in the contract. Contractors and development houses should be selected on expertise as well as service.

Contractors and development houses should ensure that they offer a complete solution to the customer. Design work should be properly documented and priced into the contract so that the documentation can be easily handed over to the customer. Contractors should notify potential and current customers of their skill sets that may be of value to the customer. There may also be potential overseas customers that require certain niche skill sets that some South African R&D companies possess.

Companies should ask that a general NDA (non-disclosure agreement) be signed to protect the company’s current IP. It may be prudent to also specify in the NDA that the outsourcing vendor should not do business with a direct competitor of the customer for a specified period of time. Companies that are dubious about outsourcing can possibly use reputable vendors that respect intellectual property in combination with NDAs.

Conclusions

Staffing is and will continue to be the main sourcing method used by companies to perform R&D. The main reason for this is that R&D companies believe that their core R&D capabilities must be kept within the company.

Staff are seen to be more trustworthy with the company’s intellectual property and are needed for some necessary R&D-related functions such as working with the customer on some solutions. However, unfavourable factors such as salary costs and the difficulty in utilising staff efficiently when R&D workloads fluctuate significantly do exist.

Factors driving R&D outsourcing are potential cost savings, benefits of getting non-core R&D tasks completed if skills don’t exist in current staffing arrangements, and alleviating short- to medium-term spikes in the R&D workload. However, unfavourable factors such as the overheads of managing outsourcing vendors, potential intellectual property issues and problems arising from misunderstandings inhibit greater adoption of outsourcing.

Some companies prefer to import certain products developed overseas rather than developing these products in-house, where this makes business sense. Factors such as costs, risks, scalability and technology influence multisourcing decisions.

For more information contact Warren Bilgeri, [email protected]

© Technews Publishing (Pty) Ltd | All Rights Reserved