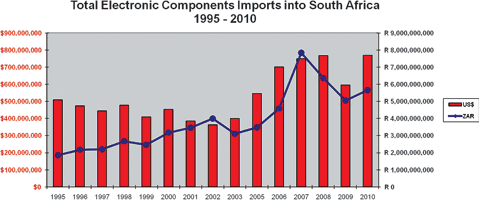

The last four years have been a rollercoaster ride for the South African electronics industry. As the accompanying import statistics show, the country experienced a significant decline in imports of electronic components in 2009 due to the 2008 global financial crisis.

During 2010 the SA economy recovered and electronic imports were on the increase again. In terms of component sales, this recovery was only realised towards the second half of 2010 and continued into 2011. According to ADEC (Association of Distributors and Manufacturers of Electronic Components) statistics, the year-on-year growth for electronic component sales for the 12 month period ending June 2011 was 8,1%. The SA electronics industry not only lags global trends by about 12 months, but these trends are also dampened significantly, which is welcome in a recessionary period.

In order to determine how we are doing compared to global markets, we should be looking slightly back into global trends. Sales growth of global semiconductors surged by around 32% in 2010 which can be correlated with our own growth of 8,1%. The more interesting analysis is to consider what is happening currently in the US and Europe in order to speculate about what we can expect in South Africa during 2012.

During 2011, US and European financial turbulence followed hard on the heels of the massive earthquake in Japan, causing imbalances in semiconductor supply and demand. The International Distribution of Electronics Association (IDEA) has indicated that there is a billings growth of between 8% and 12% for Q2 2011 compared to Q2 2010 for European countries. Their statistics indicate that the European growth rate is on a sharp decline. The concern is that there is now a negative book to bill ratio for the first time since Q3 2009.

Analysts further forecast that global semiconductor sales will grow a slower 5% in 2012. The global semiconductor industry in 2012 could be impacted by a number of macroeconomic issues, including high unemployment in the US, the ongoing debt crisis, the odds of a double-dip recession in the United States and Japan, and the fear of inflation in China, India and Brazil.

From a pure correlation perspective, we can expect that the growth rate of 8,1% of component sales in South Africa may decline to 4% towards the end of 2012. However, we need to look at the South African industry to refine this correlation.

Electronic products such as smartphones, media tablets, mobile PCs, set-top boxes, LCD TVs, wired networks, industrial automation and automotive infotainment will be the major drivers of electronics sales worldwide. However, the South African industry is very weak in most of these areas.

There are major projects on the horizon which may stimulate the growth of the SA electronics industry in the coming two years. The digital terrestrial television (DTTV) switchover project and smart metering are probably the two most important factors which may stimulate the electronics industry in the medium term. At this stage, however, nothing is certain and government and state owned enterprises such as Eskom will play a major role in realising this growth.

Risks that we should be cautious of include the replacement of locally manufactured products with complete imported products or kits. High risk areas are automotive related products, set-top boxes and electricity meters. Many of these products are currently being exported and it will be a loss for the South African economy if R&D and manufacturing is reduced. The electronics industry needs to work closer with government to protect and grow these industries.

The South African electronics industry has always been very innovative and new ideas should be applied towards local R&D and manufacturing of global trends such as energy efficient products. LED lighting is a good example of some good innovation which is currently taking place in South Africa.

From an ADEC perspective, it is critical that component distributors ensure that they continue to add adequate value into the supply chain which will make it attractive for manufacturers to deal through credible distribution channels. ADEC has become an important industry organisation to ensure that the electronics industry is stimulated and protected within South Africa. ADEC also has strong representation within the South African Electronics Industry Federation (SAEIF) which is working closely with the Department of Trade and Industry to protect and grow the electronics industry.

One of the initiatives where ADEC is very much involved is reviewing current import duties in order to promote local manufacturing. We have observed an alarming trend in recent months where key R&D and manufacturing companies are in the process of downscaling their workforce with the intent to import complete manufactured products. Many electronic components are subject to import duties, whereas completed products with such components inside, do not. This situation not only affects imports of electronic components negatively, but it will also cost jobs and affect the economy negatively. A more competitive environment with government’s support will reduce these risks.

The new ADEC statistics for the second half of 2011 will be available during January 2012. Hopefully we can sustain the current growth rate of 8,1% for component sales throughout 2012. The outlook for 2012 is cautious optimism for growth, but all industry players, including government, need to work together to ensure that growth within the electronics industry is sustainable in the long term.

For more information contact Kobus Botes, ADEC, +27 (0)11 923 9705.

© Technews Publishing (Pty) Ltd | All Rights Reserved