Despite a small increase in the first quarter of 2010, inventory levels among semiconductor suppliers remain at low levels, and days of inventory (DOI) could be interpreted as being significantly less than company financial reports indicate, according to iSuppli.

Global semiconductor inventory amounted to $25,73 billion in the first quarter of 2010, up by a scant 1,0% from $25,48 billion in the previous quarter and rising by a mere 0,2% from the first three months of 2009. Inventory in the second quarter is forecast to rise 3,3% to $26,60 billion, continuing the slow upward movement that began at the start of this year.

When measured in terms of DOI, supplier stockpiles for the semiconductor product categories tracked by iSuppli appear to be within the range of normal seasonal equilibrium. However, iSuppli believes these numbers are misleading and that the supply chain is actually leaner than current levels indicate.

At 69 days in the first quarter, DOI rose by 3,2% from 66,8 days during the fourth quarter of 2009. Such a DOI figure might give an impression – false, as it turns out – that restocking is occurring, but the DOI is inflated because of near-record-high gross margins. By using both reported revenue and inventory value in the first quarter, and then adjusting cost of goods sold (COGS) via the long-term average gross margin, DOI actually measures 20% lower than the seasonal average, iSuppli analysis indicates.

While inventories at present are not actually 20% lean, the adjusted calculation indicates that current DOI levels, as reported in company financial reports, are misleadingly elevated and that in reality, suppliers and other participants in the chain are shorter on supply than is widely perceived. iSuppli data also shows that except for a modest increase in the third quarter of 2009 and the rise of values beginning this year, inventory dollars have consistently declined since the third quarter of 2008. In addition, the current inventory figures indicate that stockpiles were not replenished in the first quarter and that device manufacturers continue to operate on ‘hand-to-mouth,’ just-in-time fulfilment schedules.

Given the current leanness of inventory, lead times have extended throughout the supply chain. Among semiconductor suppliers, capacity is straining to keep up with downstream demand, resulting not only in long lead times but also in shortages for many commodity components. Nonetheless, semiconductor suppliers are committed to controlling their side of the supply/demand equation by keeping inventory at agile, lean and manageable levels.

That being said, double ordering appears common, especially among upstream suppliers. Many companies tracked by iSuppli report book-to-bill ratios dangerously in excess of 1:1, suggesting inflated demand. However, despite the difficulty of gauging whether double orders will be put into production – let alone become an inventory problem – the semiconductor industry remains bullish on the revenue outlook for both the current quarter and the full year. This implies that double ordering will not damage the ongoing recovery now being enjoyed by the market. Bluntly put, iSuppli finds it unlikely that suppliers will buy themselves into an oversupply situation.

Just the same, the industry must maintain prudent inventory management if it is to avoid a rapid shift toward oversupply in the event that macroeconomic factors weaken end demand.

Lead times keep getting longer

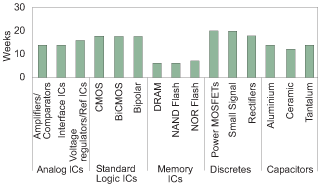

According to iSuppli, various key commodity component categories in the electronics supply chain now are in a state of short supply, causing prices to rise and lead times for customers to obtain some products to stretch to long as 20 weeks.

Market conditions at present remain very tight for analog ICs and memory ICs with demand exceeding supply. The supply situation is even more critical for standard logic ICs and power management discretes such as low-voltage MOSFETs and tantalum capacitors, which are now experiencing shortages and effectively are on allocation status, with suppliers unable to respond to unforecasted demand.

Across the board, lead times – which in the supply chain refer to the time elapsed from the moment that a customer places an order up to the juncture that the order is received – are longer than forecasts indicated a short time ago. The lead time in June was 20 weeks for discretes, 18 weeks for standard logic ICs and 14 weeks for analog ICs. In comparison, normal lead times for such products typically run to approximately 10-12 weeks. The shortest lead time to be found for any major electronic component category was in memory ICs – hovering at a relatively tame six weeks.

Among analog ICs, demand is outstripping supply, allowing manufacturers to increase average selling prices (ASPs) for the last three months. Not only is the imbalance expected to persist until the end of 2010, lead times will also continue to extend and ASPs will keep trending up, iSuppli believes. Supply also remains constrained in the case of capacitors and standard logic ICs, both of which have been swept by strong demand. For standard logic ICs, allocation is continuing for the fourth month and likely to persist until the end of the third quarter.

Similar difficulties exist in the discretes market, where supply and demand remain heavily imbalanced. Lead times – which have doubled since July 2009 – continue to extend, and the unremitting combination of strong demand and capacity constraints indicates that imbalances between supply and demand will last until the end of the year.

The situation is slightly calmer on the memory IC front, where expected future demand and inventory rebuilding efforts are being balanced off by currently soft sales as well as falling prices. Nonetheless, troubling signs point to possible severe shortages in NAND flash during the third quarter, especially if suppliers are unable to achieve an optimal mix in production.

For more information visit www.isuppli.com

© Technews Publishing (Pty) Ltd | All Rights Reserved