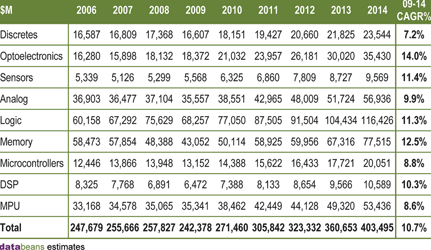

2008 turned slightly positive for the semiconductor industry, which reached $258 billion in total revenue, for a 1% annual increase from 2007.

Lacklustre performance was driven primarily by the memory segment which fell 16% from $58 billion in revenue in 2007 to $48 billion in 2008, due to the industry-wide expansion from 200 mm wafer fabrication to 300 mm fabrication processes, which has significantly increased inventory in the channel. Adding to this, Databeans predicts that the worldwide credit crunch that already has rocked the housing, automotive, and financial markets will negatively affect the semiconductor industry in 2009.

The two semiconductor markets that will be most damaged by consumer woes in 2009 will be the automotive and computer segments, which are predicted to drag total semiconductor sales down 6% to $242 billion.

The automotive sector in particular is in turmoil in the United States, and could face near collapse in 2009 according to industry analysts. Growing concerns about credit and leasing, declines in vehicle equity, and general economic stress are causing consumers to keep their current vehicles several months longer than in previous years. These issues have caused JD Power and Associates to predict total light vehicle sales in the US to drop to 13,2 million units in 2009 from 13,7 million units in 2008, with industry recovery not projected for at least another 18 months.

Similar issues have adversely affected the PC market, particularly in the US, where the worldwide recession has been felt the hardest. Year 2009 will see PC revenue in the US drop by 5%, the first major drop in revenue since the Internet bubble burst in 2001. Worldwide, however, the PC market will continue to grow, albeit by just 2%, as more consumers choose to keep older models. Enterprises will also make do with the servers and workstations they already have as the financial crisis and the problems with the credit market will cause most companies to hold off on buying new hardware.

Despite the global woes expected for the semiconductor industry in 2009, Databeans predicts the market will rebound strongly and improve 12% in 2010, thanks to new technologies, government plans and increased consumer confidence. Memory will make a significant comeback by way of industry-wide incorporation of solid state technology into a myriad of application segments and hybrid drives that combine with traditional rotating HDDs in PCs. This is projected to help stabilise memory pricing, which has been steadily declining over the last year.

US president-elect Barack Obama’s $15 billion government bailout of GM, Chrysler and Ford is projected to help the auto industry regain profitability over the next two years, as news of the bailout has already improved share pricing for the Big Three by 15%. Obama’s rescue package also plans to create 2,5 million new jobs in the industry by 2010, which in addition to restoring US consumer confidence, would likely help to improve the electronics industry as well.

Databeans predicts that despite the slight decrease in 2009, the semiconductor industry as a whole will continue to experience compound annual growth of nearly 11% over the forecasted period, ensuring it is one of the world’s fastest growing and most profitable technology markets.

For more information visit www.databeans.net

© Technews Publishing (Pty) Ltd | All Rights Reserved