Surprising weakness in the memory chip market in the fourth quarter took the wind out of the sails of the global semiconductor market, causing growth in 2007 to fall short of expectations, according to iSuppli.

Global semiconductor market revenue grew by only 3,3% in 2007, based on the results from iSuppli's final 2007 chip market share data. In a preliminary estimate released in November, iSuppli predicted the global chip market would grow by 4,1% in 2007.

Worldwide DRAM revenue fell by 19,1% in the fourth quarter compared to the third. This compares to iSuppli's earlier forecast of a 4,7% decline. Meanwhile, NAND flash revenue declined by 3,9% in the same quarter, well below the previous forecast of 3% growth. This caused memory chip revenue in the fourth quarter to decline by 11% sequentially, down from the prediction of 1,2% growth in overall memory chip revenue.

Weak market conditions had a major impact on most memory suppliers in 2007, including Nanya Technology and Qimonda, which saw their memory IC revenues fall by 32,4% and 26% respectively for the year.

The world's leading supplier of memory chips, Samsung, experienced a decline of 3,3% in its memory semiconductor revenue in 2007 - contributing to a 0,8% decline in total chip revenue for the year.

However, there were some exceptions to the weak conditions in the memory segment. Hynix and Toshiba and Elpida Memory achieved memory-chip revenue growth of 15, 14,5 and 8,8% respectively in 2007.

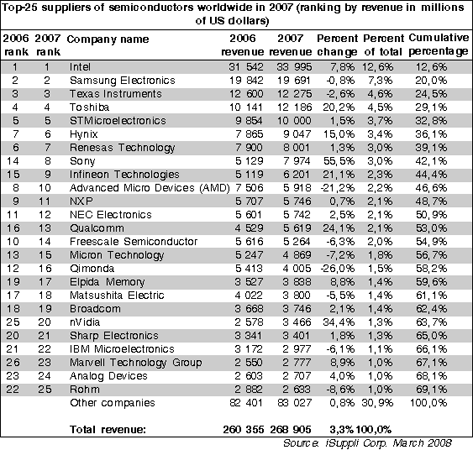

The attached table presents iSuppli's final rankings for the world's Top 25 semiconductor suppliers in 2007.

Outside of the memory segment, several companies and product categories posted impressive performances. Infineon Technologies in 2007 jumped to the world's No. 9 ranking among global semiconductor suppliers, up from 15th in 2006. During 2007, Infineon acquired Texas Instruments' DSL Customer Premise Equipment (CPE) chip business and its wireless baseband semiconductor unit, adding a boost to its revenue. Infineon had fallen out of the Top 10 ranking in 2006 after it split out its memory unit to form Qimonda.

Infineon in 2007 returned to the Top 10 rankings with a revenue rise of 21,1% compared to 2006 due a combination of organic expansion and new revenues from its acquisitions. Sony achieved extraordinary growth of 55,5% in 2007, propelling it to No. 8 in the global rankings, up from No. 14 in 2006. However, it must be noted that this growth was driven by business within Sony. The key factor behind this growth was demand for chips for Sony's own PlayStation 3 (PS3) video-game console.

Toshiba also benefited from supplying chips for the PS3 as well as its success in NAND Flash memory. The Tokyo-based semiconductor supplier attained the third-highest revenue growth among the Top 10 suppliers in 2007 with an increase of 20,2% from 2006. This has positioned Toshiba to vie with Texas Instruments for the world's No. 3 rank in 2008.

Fabless is fabulous

With the exception of Sony, it was two US fabless semiconductor suppliers - Qualcomm and nVidia - that led the growth among the Top 25 chip companies during 2007. Qualcomm's revenues grew by 24,1% as it moved up three positions in the rankings to reach 13th place. For the first time, a position in the Top 10 is within reach of a fabless semiconductor supplier. nVidia achieved revenue growth of 34,4% and leaped from No. 25 to No. 20 in the rankings. nVidia's revenues also received an additional boost from its acquisition of PortalPlayer during 2007.

The big get bigger

Overall, the Top 25 semiconductor suppliers significantly outperformed the combined performance of companies ranked lower than them in 2007. The Top 25 as a group achieved revenue growth of 4,5%, while the combined growth of all other semiconductor suppliers was only 0,8%.

Chip highlights

Other notable developments in the 2007 semiconductor market included:

* Logic application specific integrated circuits (application specific standard products and ASICs) enjoyed the strongest performance of all semiconductor segments in 2007 with growth of 12,9%. Sony and Toshiba were the key drivers of growth in this segment due to their sales of semiconductors for the PS3. Among the Top 10 suppliers in this market, nVidia also achieved an outstanding year.

* Other product categories that enjoyed above-average revenue growth in 2007 were optical semiconductors, with a 7,4% rise and sensors and actuators with a 7,3% expansion. Discrete semiconductors even managed growth of 4,2%.

* In the microcomponent category, Intel enjoyed a return to healthy growth in its microprocessor revenue, with an 8% rise in 2007. This growth came at the expense of fellow US-based firm Advanced Micro Devices, which saw a significant decline in its microprocessor revenues. Overall, microprocessor revenue grew by 2,1% in 2007.

* Global revenue growth for analog ICs amounted to 2,9% in 2007. Among the Top 10 suppliers of analog ICs, Qualcomm and Infineon delivered notably strong revenue growth with increases of greater than 20% for the year.

* Among applications for semiconductors, automotive electronics drove the highest growth opportunities in 2007 with 11,2% growth. Regionally, Asia/Pacific accounted for the highest regional growth as it expanded by 6,6% in 2007.

For more information visit www.isuppli.com

© Technews Publishing (Pty) Ltd | All Rights Reserved