South Africa

• The Independent Communications Authority of South Africa (ICASA) has invited applications for radio frequency spectrum to provide mobile broadband wireless access services for urban and rural areas using the complimentary bands IMT700, IMT800 and IMT2600. ICASA stated that the main aim of licensing 700 MHz, 800 MHz and 2600 MHz is to ensure nationwide broadband access for all citizens by 2020 in line with the National Development Plan (NDP) and SA Connect policy.

• Professor Bheki Twala from the University of Johannesburg (UJ) received the prestigious annual TW Kambule-NSTF Award for his work building on diverse expertise in making decisions given incomplete information, and utilising artificial intelligence (AI) techniques for predicting and for the classification of tasks in several fields such as banking and finance, insurance, biomedical, robotics, psychology, software engineering and most recently in electrical and electronic engineering science.

Overseas

Business

• According to a report in The Korea Times, Qualcomm is facing a hefty fine by Korea’s Fair Trade Commission (FTC). Following a 17 month investigation, the FTC allegedly intends to impose a 1 trillion won (roughly 12,6 billion Rand) over Qualcomm’s unfair practices with respect to how it charges for royalties, and the terms under which it allows its affiliates to manufacture chipsets.

• Net revenues for STMicroelectronics’s second quarter increased 5,6% sequentially and decreased 1,7% year-over-year when excluding its businesses undergoing a phase-out (mobile legacy products, camera modules and set-top box). Net profit was $23 million, equivalent to $0,03 per share, compared to a net loss of $41 million in the prior quarter and a net income of $35 million in the year-ago quarter, which included a one-time income tax benefit.

• ARM Holdings announced its unaudited financial results for the quarter ended 30 June 2016, posting revenue of £267,6 million – a 17% increase over the same period last year – and normalised earnings per share of 8,6 pence (up 18% year-on-year). During the latest quarter, 25 processor licences were signed by a broad range of major technology companies, and 3,6 billion ARM-based chips were shipped, up 9% year-on-year.

• Texas Instruments reported second-quarter revenue of $3,27 billion, net income of $779 million and earnings per share of 76 cents. These figure compare favourably with the second quarter of 2015, when revenue was $3,23 billion, net income was $696 million and earnings per share were 65 cents. While analog revenue stayed mostly flat, revenue growth was driven by the company’s embedded processing business, which includes microcontrollers, processors and connectivity.

Companies

• ams has closed the transaction to acquire 100% of the shares in German colour and spectral sensing systems specialist MAZeT for an undisclosed amount in cash. Focused on industrial and medical applications, MAZeT’s capabilities include IC and filter design, as well as hardware and software system development. Its JenColor sensors are currently being used in applications including aeroplane interior lighting, agricultural sensors and medical skin lesion analysis.

• SoftBank Group, a Japanese company that operates across a number of technology sectors, has agreed terms for the all-cash acquisition of ARM Holdings, the world leader in developing and licensing intellectual property (IP) for microprocessor architectures. The deal, which carries a price tag of £24 billion, is expected to close before the end of September 2016. Softbank intends to preserve the ARM organisation, senior management and partnership based business model, and has provided assurances to at least double the employee headcount in the UK and to increase the headcount outside the UK over the next five years.

• Infineon Technologies has entered into a definitive agreement to acquire Cree’s Wolfspeed power and RF division. The deal also includes the related SiC wafer substrate business for power and RF power. The purchase price for this planned all-cash transaction is $850 million. This acquisition will enable Infineon to provide the broadest offering in compound semiconductors and will further strengthen its position in high-growth markets such as electro-mobility, renewables and next-generation cellular infrastructure relevant for IoT.

• RS Components has secured a distribution agreement allowing it to offer the complete Intersil product range to its customers in all territories worldwide. The Intersil product range includes solutions for battery management, digital power, high-speed data conversion and signal conditioning, in addition to optoelectronic, audio, interfacing, switching and multiplexing, and high-reliability product lines.

• Linear Technology has agreed to an offer to be acquired by Analog Devices, in a cash and stock transaction that values the combined enterprise at approximately $30 billion. Their merger would create an analog semiconductor powerhouse with approximately $5 billion in anticipated annual revenues. The transaction has been unanimously approved by the boards of directors of both companies, and is expected to close by the end of the first half of calendar year 2017.

Technology

• Scientists at the Kavli Institute of Nanoscience at the Netherlands’ Delft University have built a 1 KB memory where each bit is represented by the position of a single chlorine atom. In theory, this storage density would allow all the information contained in every book ever created by humans to be stored on something the size of a postage stamp. They attained a storage density of 500 terabits per square inch, 500 times better than the best commercial hard disk currently available.

• Imagination Technologies has implemented Intrinsic-ID’s leading security and authentication technology on its MIPS M-class M5150 CPU that targets low-power applications such as M2M, IoT and embedded control. Intrinsic-ID’s Physical Unclonable Function (PUF) technology allows efficient implementation of security functions such as device authentication and anti-cloning on MIPS CPUs.

Industry

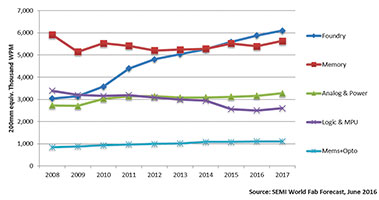

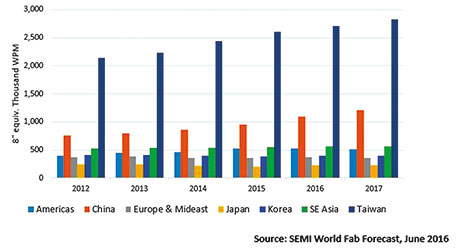

• According to SEMI’s World Fab Forecast, overall semiconductor foundry capacity has surpassed memory capacity in 2015 as the largest segment, and is expected to continue to lead in the coming years. Foundry capacity growth is forecast to outgrow the overall industry at about 5% each year to reach 6 million wafers per month (200 mm equivalent) by the end of 2017. Taiwan is the region with the largest capacity – accounting for over 55% of the world’s 300 mm foundry capacity – while China is the fastest growing region and is expected to account for almost 20% by the end of 2017.

• The Semiconductor Industry Association (SIA) announced worldwide sales of semiconductors reached $26,0 billion for the month of May 2016, an increase of 0,4% compared to the previous month’s total, but a decrease of 7,7% compared to the May 2015 figure. Regionally, month-to-month sales increased in China (3,1%), but slipped slightly in the Americas (-0,1%), Europe (-0,8%), Asia Pacific/All Other (-0,8%) and Japan (-1,8%).

• With the new technical enhancements enabled by Bluetooth 5, in addition to the support of mesh networking and Internet protocol, ABI Research forecasts Bluetooth-enabled device shipments will increase by an average of half a billion per year through 2021, reaching more than 5 billion. Bluetooth Smart or Smart Ready devices, combined with market growth in the connected home for speakers, remote controls, smart televisions and game consoles, has and will continue to help drive the market in the coming years, but it is beacons that represent one of the largest opportunities for Bluetooth-enabled devices. By 2021, it will be the third largest market for Bluetooth devices, and the fastest growing of all segments.

© Technews Publishing (Pty) Ltd | All Rights Reserved