Africa

Altech is set to dispose of its 8,6% stake in Liquid Telecommunications Holdings (Liquid). It acquired the stake as part of the disposal of its East African operations to Liquid in February 2013, as part of an agreement that included a put option for the greater of US$50 million or fair market value of the shares. An announcement on 10 January 2014 confirmed that the put option had been exercised by Altech and the value of the stake was agreed between the parties at $55 million. The consideration is payable to Altech on 28 February 2014.

Overseas

Business

Intersil announced financial results for its fourth quarter and year ended 3 January 2014. The company’s revenue of $146 million was up 6% compared to the fourth quarter of 2012, while GAAP net income of $7,5 million (earnings per share (EPS) of $0,06) for the fourth quarter resulted in a return to profitability for the full year.

Net sales for Freescale Semiconductor’s fourth quarter of 2013 were $1,08 billion, compared to $1,09 billion in the third quarter of 2013 and $957 million in the fourth quarter of 2012. Net sales for calendar year 2013 were $4,19 billion, compared to $3,95 billion in calendar year 2012. Net loss for the fourth quarter 2013 was $118 million, or $0,46 per share, compared to net earnings of $23 million, or $0,09 per share, in the third quarter of 2013 and a net loss of $35 million, or $0,14 per share, in the same period in the prior year. The net loss for calendar 2013 was $208 million or $0,81 per share, compared to a loss of $102 million or $0,41 per share in 2012.

Announcing results of operations for its first quarter of fiscal 2014, Micron Technology reported revenues of $4,04 billion, some 42% higher than the fourth quarter of fiscal 2013 and 120% higher than the first quarter of fiscal 2013. On a GAAP basis, net income was $358 million, or $0,30 per diluted share, compared to net income of $1,71 billion, or $1,51 per diluted share, in the fourth quarter of fiscal 2013 and a net loss of $275 million, or $0,27 per diluted share, in the first quarter of fiscal 2013.

Texas Instruments reported fourth-quarter revenue of $3,03 billion, net income of $511 million and earnings per share of 46 cents, but these positive results were not enough to save the jobs of some 1100 of the company’s employees. TI says it is not exiting any markets or discontinuing any existing products but will reduce investments in markets that do not offer sustainable growth and returns. The company expects this move to bring annualised savings of about $130 million by the end of 2014, and will incur restructuring charges of $80 million, of which $49 million was included in the fourth quarter of 2013 and about $30 million will be included in the first quarter of 2014.

Intel announced that it will axe 5% of its global work force this year, and has cancelled the opening of Fab 42, which was conceived to manufacture the company’s most advanced processors. This comes shortly after CEO Brian Krzanich admitted during the company’s fourth quarter earnings conference call that it had overestimated demand for PC chips when it planned Fab 42 three years ago. As for its results, Intel reported full-year revenue of $52,7 billion, net income of $9,6 billion and EPS of $1,89.

Companies

Tektronix announced the acquisition of Picosecond Pulse Labs, in a move intended to strengthen its portfolio in the growing market for test equipment to support 100G/400G optical data communications research and development. According to Tektronix, privately-held Picosecond offers products that include ultra-high-speed pattern generators, the world’s fastest pulse generators and highest bandwidth sampler modules. The terms of the transaction were not disclosed.

Industry

The Ethernet Alliance, a global consortium dedicated to the continued success and advancement of Ethernet technologies, has formed a new Power over Ethernet (PoE) subcommittee whose mission is to help expand the IEEE’s growing library of PoE standards and extend the range of applications and devices using the technology.

The EDA Consortium announced that the Electronic Design Automation (EDA) industry’s revenue increased 6,8% for the third quarter of 2013 to $1,73 billion. Total revenue for the most recent four quarters was $6,83 billion. Companies that were tracked employed 29 967 professionals in Q3 2013, an increase of 3,8% compared to Q3 2012.

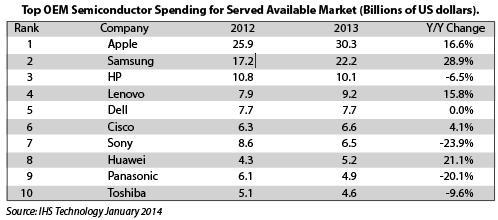

Apple and Samsung remained the world’s largest buyers of semiconductor chips in 2013, but the intensifying battle between the two for the hearts and minds of consumers in their product offerings could presage another mighty showdown this year for the top ranking, according to a new report from IHS Technology.

Apple was in first place with chip spending in 2013 of $30,3 billion, handily outspending runner-up Samsung with $22,2 billion. However, the South Korean electronics titan attained the largest spending increase on chips of any top 10 OEM last year, up almost 30% from 2012 levels, compared to a smaller expansion of 17% on the part of Apple. The accompanying table shows the results for these as well as the other top 10 OEM chip buyers.

© Technews Publishing (Pty) Ltd | All Rights Reserved